Forums » News and Announcements

Find out what IC Markets offers

-

Find out what IC Markets offers

IC Markets has its headquarters in Sydney as an Australian company. Andrew Budzinski founded this trading platform in 2007, having founded another broker earlier (FP Markets).To get more news about ic markets review, you can visit wikifx.com official website.

Although it is less popular than other online brokers, such as Etoro, DEGIRO, or XTB, some traders prefer it due to its low commissions and platform flexibility (e.g. MetaTrader and cTrader).

Similarly, as with any broker, you will want to examine your options and determine if this is the right choice for you or if there are better alternatives. You may find my IC Markets review helpful in deciding whether IC Markets suits you.

With IC Markets, you can trade CFDs on stocks, currencies, commodities, crypto, bonds, indices, and other derivatives. Since this broker does not have a trading platform of its own, traders will need to use cTrader, MetaTrader 4 or 5.Kindly note that the only asset classes available for investment are CFDs (Contracts for Difference). It is not possible to trade stocks or other underlying assets. Despite the higher risk involved, this makes IC Markets an attractive choice for traders.

Different governmental and international agencies regulate the Australian broker, such as CySEC in Cyprus, ASIC in Australia, and the FSA in the United Kingdom. Since it is not a publicly traded company, it does not undergo as many inspections as other listed brokers (e.g. NAGA, XTB).

Many countries within and outside the European Union can access IC Markets, including the United Kingdom, Australia, Germany, France, LatAm and many more.

Opening a demo account with IC Markets is a simple process.

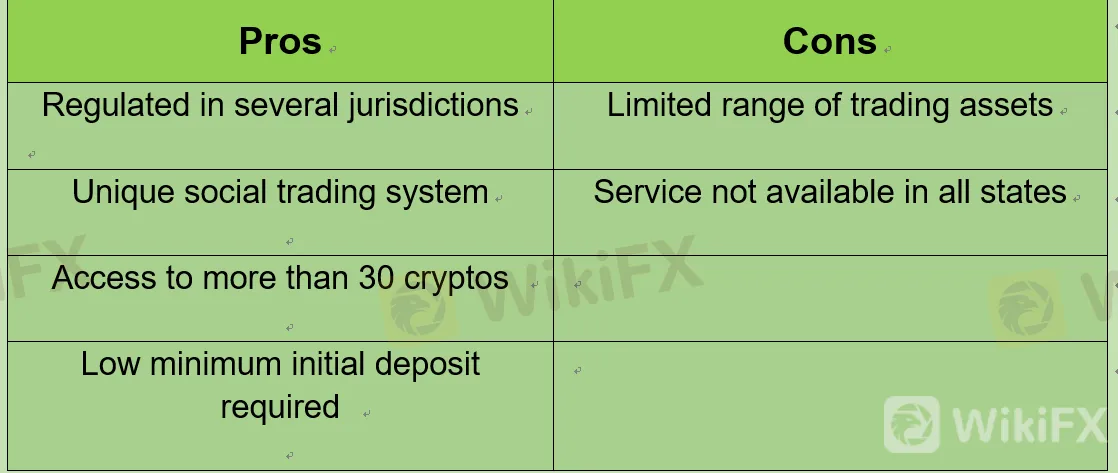

As a trading platform, IC Markets is regulated by several important regulators (such as the Australian, European, British, etc.).

In addition to MetaTrader 4 and 5, cTrader can also be used as an external platform.

Depending on your trading type, you can choose from three types of accounts (with varying commissions).

Trading options include social trading (through Zulu Trade) and algorithmic trading (using programming to streamline your investment process).

Opening an account, depositing, or withdrawing funds are all free. You won’t be charged for inactivity, either.

It is possible to open an account in a variety of currencies. Among them are USD, EUR, AUD, JPY, and GBP.

MetaTrader 4, and 5 (and even cTrader’s) interface are quite outdated. The IC Markets interface might confuse you if you’re used to modern brokers.

The only thing you can trade is CFDs. IC Markets is not your best choice if you invest in tangible assets such as stocks or ETFs.

Support is friendly, but they don’t always give thorough answers.

Despite offering a wide range of instruments, such as CFDs, to invest in, they are not as diverse as other brokerages. (e.g., only [sc name="ic-markets-cfd-indicies"][/sc] indexes and a dozen or so commodities).

While you can trade equity CFDs, only stocks listed on ASX, Nasdaq, and NYSE are available. While you can trade equity CFDs, there is not a wide range of stocks available, only those listed on the Australian Stock Exchange (ASX), the Nasdaq and the NYSE.

IC Markets does not support two-step authentication (e.g. with a mobile code), which would provide an extra layer of security when logging in. The fact that they send your password and username via email seems strange too. Ideally, you should be able to decide both for yourself.

IC Markets doesn’t provide any financial information about the assets you’re investing in (e.g. income statements, financial ratios for equity CFDs).