Forums » News and Announcements

AVATRADE REVIEW

-

AVATRADE REVIEW

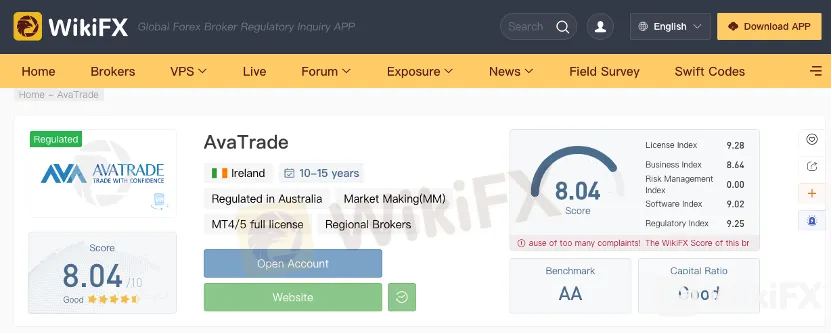

A fully regulated broker with a presence in Europe, South Africa, the Middle East, British Virgin Islands, Australia and Japan, Avatrade deals with mainly forex and CFDs on stocks, commodities, indexes, forex, cryptocurrencies, etc. This brokerage is headquartered in Dublin, Ireland and began offering its services in 2006. It offers multiple trading platforms and earns mainly through spreads.To get more news about AvaTrade Pros & Cons, you can visit wikifx.com official website.

AvaTrade has been facilitating online trading since 2006 and has offices all over the world. But as with any brokerage (especially when dealing with forex!), you need to ensure your trades and investments are safe, fees and commissions are reasonable, and customer service is on point.

Who Uses AvaTrade?

AvaTrade caters to the needs of diverse client groups due to the options it provides in terms of its trading platforms/software and tradable asset classes.Beginners. With the firm’s intuitive and simple interface and the solid backup provided by the AvaTrade’s customer support team, a beginner can easily and comfortably navigate through the complex investing world. The firm also provides specialized educational content for beginners to acquaint them with trading. A case in point is its “Trading for Beginners” section.

Advanced Traders. AvaTrade allows desktop, tablet, mobile and web-based trading with Meta Trader 4 and AvaTradeGO, which provide choices for advanced traders. It has a range of automated trading platforms and EA compatibility. The firm also conducts free webinars targeting traders at all levels.

Traders seeking well-diversified portfolios. The 250+ instruments in stocks, commodities, indexes, forex, CFDs and cryptos help traders diversify their portfolio and in turn mitigate the risk involved.

AvaTrade Commissions and Fees

Account opening requires a minimum deposit of $100 if the deposit is made through credit card or wire transfer. The minimum opening balance depends on the base currency of a client’s deposit.For forex trading, Avatrade doesn’t charge any commission on any trade but is compensated through the bid-ask spread. If the spread is 3 pips on 1,000 units of a currency pair, then the compensation to the brokerage amounts to $0.30.

The firm also charges inactivity fees of $50 for 3 consecutive months of non-use. The inactivity fee will be deducted from the customer’s trading account. AvaTrade charges an administration fee of $100 after 12 consecutive months of non-use.

Research from AvaTrade

AvaTrade carries a wide range of educational tools in a webpage dedicated for education. It provides educational content for beginners, focusing on online trading forex, CFD, along with technical analysis. It also provides information on order types and economic indicators that impact currency market.An ebook is available for download by clients. Online videos on topics such as advanced trading tools, beginner lessons, forex trading strategies, MetaTrader 4 for beginners, MetaTrader 4 Guide and MyAva guide are available for use.

AvaTrade has a dedicated website called “The Sharp Trader,” which provides all information a trader may need for trading. It has videos that explain various topics needed by traders with different levels of trading knowledge, daily technical and fundamental analysis by the firm’s market analyst, analytical videos and trading tools, including an economic calendar, trading platforms, calculators, etc.