Forums » News and Announcements

Margin Call movie explained: the true story of 2008 crisis

-

Margin Call movie explained: the true story of 2008 crisis

Margin Call is a 2011 film from first-time director J. C. Chandor. With a top class cast that includes Kevin Spacey, Jeremy Irons, Paul Bettany, Stanley Tucci and Demi Moore, it is considered to be one of the crudest and most realistic frescoes of how Wall Street works in modern times. The film deals with topics of a financial nature that are a little more technical than usual, and as the plot progresses it becomes clear that something really big is about to happen that day, but it is not clear what this really means. Bitterly, what you see in the film is inspired by what really happened in the financial crisis of 2007-08. Let’s try to explain what happens.

Times are hard in a large American investment bank (whose name is unknown). There are layoffs in progress, it is necessary to contain costs. Among the employees fired that day is an important element, Eric Dale (Stanley Tucci), the head of the risk department. As Eric leaves the company, he tries to convince several colleagues that there is something important he was working on, but no one takes it seriously. Eventually he passes a USB stick to one of the newcomers to the company, Peter Sullivan (Zachary Quinto).To get more news about margin call, you can visit wikifx.com official website.

Peter spends the evening working overtime and finds out what Eric wanted to warn them about: projections have been made about the likely volatility of the value of some particular products that the bank has been selling for years. Based on a probable scenario of market trends, the value of those products could fall very soon, and if this happens, the entire total financial holdings of the bank would not be enough to cover the losses. In simpler words: over the last few years the bank has exposed itself too much, selling and buying products that are quite risky for its customers, and if the value of those products falls as expected, the bank goes bankrupt.This is very serious, and within one night the entire executive committee from the bank is involved, including CEO John Tuld. In sharing the nature of the risk, it is curious to see that none of the bank’s executives have the technical skills to understand precisely what those products consist of, a sign that the creation of these products was a venture that required so much complexity that nobody really understand them. We only know that they sold and did sell well, and that was enough. In this the film clearly shows how Wall Street works: the goal is to make money, and if you need to resort to unorthodox practices, that’s okay anyway.

In the meeting with the CEO, Tuld realizes that the collapse of the markets is about to erupt. “I’m here to guess what the music might do a week, a month, a year from now. And standing here tonight, I’m afraid that I don’t hear a thing. Just… silence.” The analysis of the situation and the predictions presented by Peter give Tuld the clear signal that it is time to save what can be saved. He therefore asks for an unprecedented operation: the sale of all the bank’s financial assets the following day, preferably before lunch, before the rumor starts to circulate and the value of the products they are selling begins to fall. This triggers the scruples of Sam (Kevin Spacey), but in the end it succeeds: the bank sells everything and triggers the collapse of the markets and the financial crisis to come. In the film, at the end of the day the CEO reassures the survivors of the operation, saying that there will be a lot of money to be made on this occasion too and the best men are needed.The film does not mention or name any real-life characters or real history, but the reference to the financial crisis of 2007-2008 is clear in every aspect, including CEO Tuld’s final speech to Sam, in which Tuld lists all the major financial crises in the world. history and reaches the gates of 2008, a sign that this is precisely the crisis that is about to arise. The film is therefore inspired by the subprime mortgage crisis of 2007 and by Lehman Brothers, which filed for bankruptcy in 2008. To confirm the reference, the name of the CEO in the film – John Tuld – closely resembles that of the real CEO of Lehman, Dick Fuld.

The film is therefore a realistic mirror of how Wall Street works. Investment banks and brokers are operators who buy and sell for their customers, with the aim of making them earn (and earn themselves). If there is an opportunity to earn more, even if it is risky, it is seized, often without full awareness of what risks this entails. This in the film is clear from how the risk analysis department is hardly visible and listened to by others, and how the products that the bank sells are not understood by practically anyone.

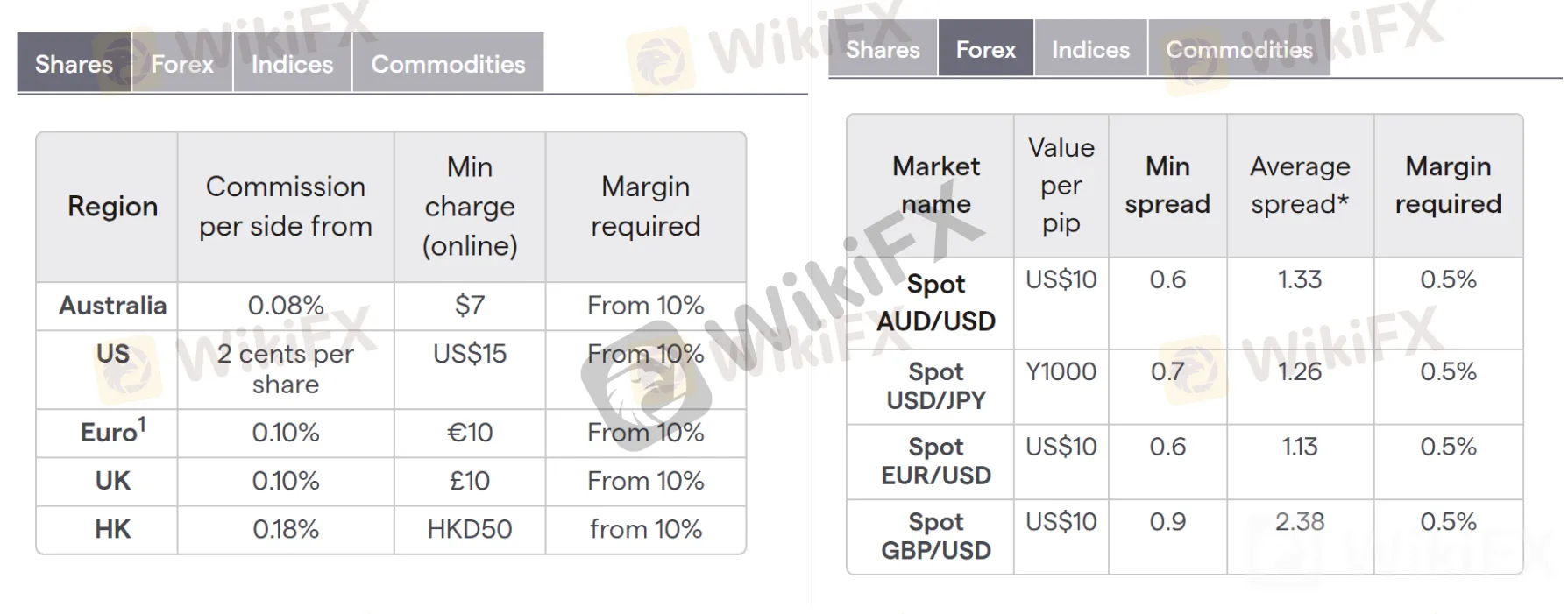

The sales day is precisely the one that puts in place the margin call. In technical jargon, the margin call is a sale operation that is carried out when it is understood that the value of the product sold has dropped to a point that new liquidity would be needed to cover the loss. The CEO’s order that night is basically to sell to all their real customers something that will be worth nothing in a few hours, to collect cash. This triggers the qualms of Sam, who as a longtime salesperson finds himself uncomfortable in the position of selling something to customers who will soon discover how much those products really are worth nothing. An immoral operation, which the CEO justifies in ethical terms (“we are selling at the current market share”, technically true, but the bank is aware that soon those values will collapse), but above all of survival: if the market collapses, our job is to save ourselves, at any cost. Even by deceiving our loyal customers.The metaphor of Sam burying his beloved dog in the film’s finale reflects the collapse of the markets: with the operation that day, it is as if the bank had dug a ditch for the burial of a dying market. They are not specifically the architects of the crisis, but those who lit the fuse with sudden sales. The market was destined to collapse anyway, as Sam’s dog was destined to die from the tumor.

How Wall Street interfaces with the world of its clients is ambiguous. From the positions of the various characters in the film, it emerges that investment banks do in all respects what they are called upon to do: create the illusion of a possible and easy gain, to guarantee the expensive lifestyle of those who invest in it. Crises happen. The bold choices of using high-risk investments are part of the game. Customers should know, and if they pretend to ignore the risks, it’s just hypocrisy. And in the end, as Tuld puts it, “it’s just money.” As professionals in the sector, brokers treat their work with the necessary detachment, and don’t worry too much if any family will have big financial losses. It is part of the market.