Forums » News and Announcements

5 Best Forex Brokers for Beginners in 2023

-

5 Best Forex Brokers for Beginners in 2023

Trading with the right broker remains essential but finding the best one among thousands on offer can be a tough challenge. That is why we have done intensive research to compile a must-read list for you below of the best Forex brokers for beginners.To get more news about best forex brokers for beginners, you can visit wikifx.com official website.

Forex trading basically refers to exchanging one currency for another one and speculating on price action. One example is buying euros for US dollars. Currencies remain quoted in pairs, with the EUR/USD the most liquid one. The first currency is known as the base currency, and the second one is a quote currency. Traders may buy or sell currency pairs, most conveniently online, via Forex brokers. A trader who buys or sells the EUR/USD exchanges euros for US dollars. One of the most notable benefits of Forex trading is leverage, which results in lower capital entry requirements versus other assets, like equities. The Forex market is the most liquid one globally, with daily turnover slowly approaching $7 trillion.

What is a Forex Broker?

A Forex broker acts as the intermediary between Forex traders and the Forex market. Some Forex brokers deploy the market-making model, profiting directly from client losses where they remain the counterparty. Other brokers use the ECN/STP/NDD execution model, matching orders and granting access to liquidity. The former has higher mark-ups in a commission-free pricing environment versus raw spreads for a fee and often a volume-based rebate program. A Forex broker also provided traders with a trading platform, either a proprietary solution, the retail market leading MT4 or the ECN favorite cTrader. Some try to push the MT5 trading platform, widely considered the failed successor to MT4. The best Forex brokers for beginners maintain a high-quality educational section, competitive market research and commentary, and excellent trading tools.How Much Money Do You Need to Trade Forex?

One of the most frequent questions of beginner traders is “How Much Money Do I Need to Start Trading Forex?” While the answer depends on individual circumstances, new traders should consider no less than $100 and only trade micro-lots. One micro-lot equals 0.01 lots or 1,000 currency units in a standard Forex trading account and is usually the minimum trade size at most brokers. A $100 portfolio suffices for beginner traders to learn how to trade in a live trading environment and presents tremendous educational value.What Are the Most Popular Currency Pairs?

The most liquid currency pair is the EUR/USD. Other major currency pairs include the EUR/JPY, the EUR/GBP, the EUR/CHF, the GBP/USD, the USD/JPY, the USD/CHF, the USD/CAD, the AUD/USD, and the NZD/USD. Per the latest Triennial Survey by the Bank for International Settlements (BIS), 88% of all Forex traders include the US dollar. The Chinese yuan (CNY) is the eighth most traded currency globally, positioned to become more dominant moving forward. Other emerging currencies to monitor are the Russian ruble, the Mexican peso, the Indian rupee, the Brazilian real and the South African rand.Can You Get Rich by Trading Forex?

Getting rich by trading Forex remains a possibility, but a rare one. It requires discipline, patience, time, and capital. Traders must first master the psychology of trading before thinking about a trading strategy. It may require more than a decade of successful trading before a portfolio reaches the necessary size to take it to the next level and become rich. Most retail traders, between 70% and 85%, face trading losses, and less than 2% earn sufficient money from trading to rely on it as their sole source of income.How Do I Start Trading Forex?

There are heated discussions about the best approach, but I recommend reading about trading psychology and Forex trading strategies suitable for beginners as first steps. The subsequent topics to study are fundamental and technical analysis. From there, learning in a live account with a small deposit and trading micro-lots presents the successful approach traders take. Many retail traders fall into the demo account trap, which provides no trading experience but can create a false sense of accomplishment.How Do I Choose a Forex Broker?

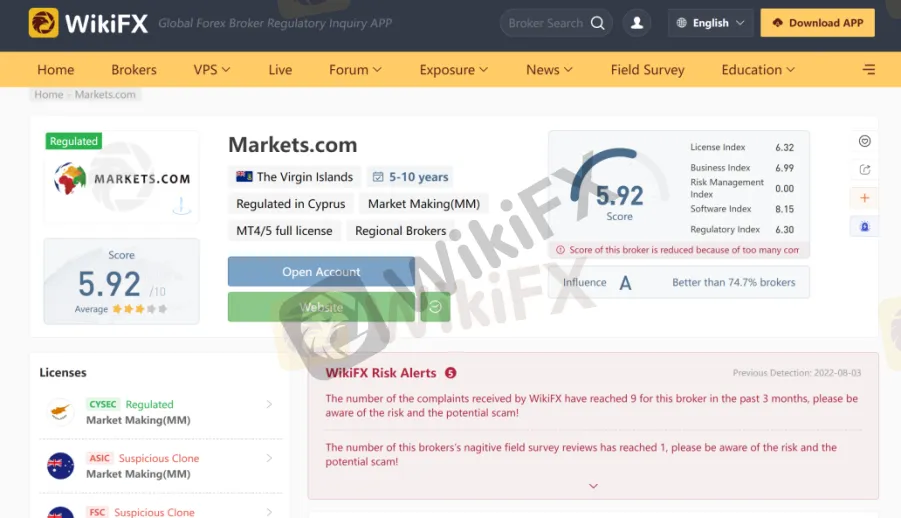

Trading with a regulated Forex broker is a must, but the regulation should not diminish the competitiveness. One example is brokers in the US and EU, which are among the most regulated ones but are equally home to the least competitive trading environments. The best brokers offer a business-friendly regulatory environment with additional safety measures. I also recommend Forex brokers with a trader-friendly commission-based pricing environment and a volume-based rebate program. Traders must ensure that their preferred broker will offer the assets they wish to trade. A cutting-edge trading platform, not just the out-of-the-box MT4/MT5 trading platforms, is another aspect to demand. High-quality trading tools demonstrate the willingness of the broker to invest in its trading environment. Finally, traders should evaluate the execution statistics of a broker, if available.