Forums » News and Announcements

The Importance of Pips in Forex Trading

-

The Importance of Pips in Forex Trading

When trading in the foreign exchange (forex) market, it's hard to underestimate the importance of pips. A pip, which stands for either "percentage in point" or "price interest point," represents the basic movement a currency pair can make in the market. For most currency pairs—including, for example, the British pound/U.S. dollar (GBP/USD)—a pip is equal to 1/100 of a percentage point, or one basis point, and pips are counted in the fourth place after the decimal in price quotes. For currency pairs involving the Japanese yen, a pip is one percentage point, and pips are counted in the second place after the decimal in price quotes.To get more news about pips in forex trading, you can visit wikifx.com official website.

Currencies must be exchanged to facilitate international trade and business. The forex market is where such transactions happen—along with bets made by speculators who hope to make money off price moves in pairs of currencies. Pips are used in calculating the rates participants in the forex market pay when carrying out currency trades.

Pips, Pipettes, and Spreads

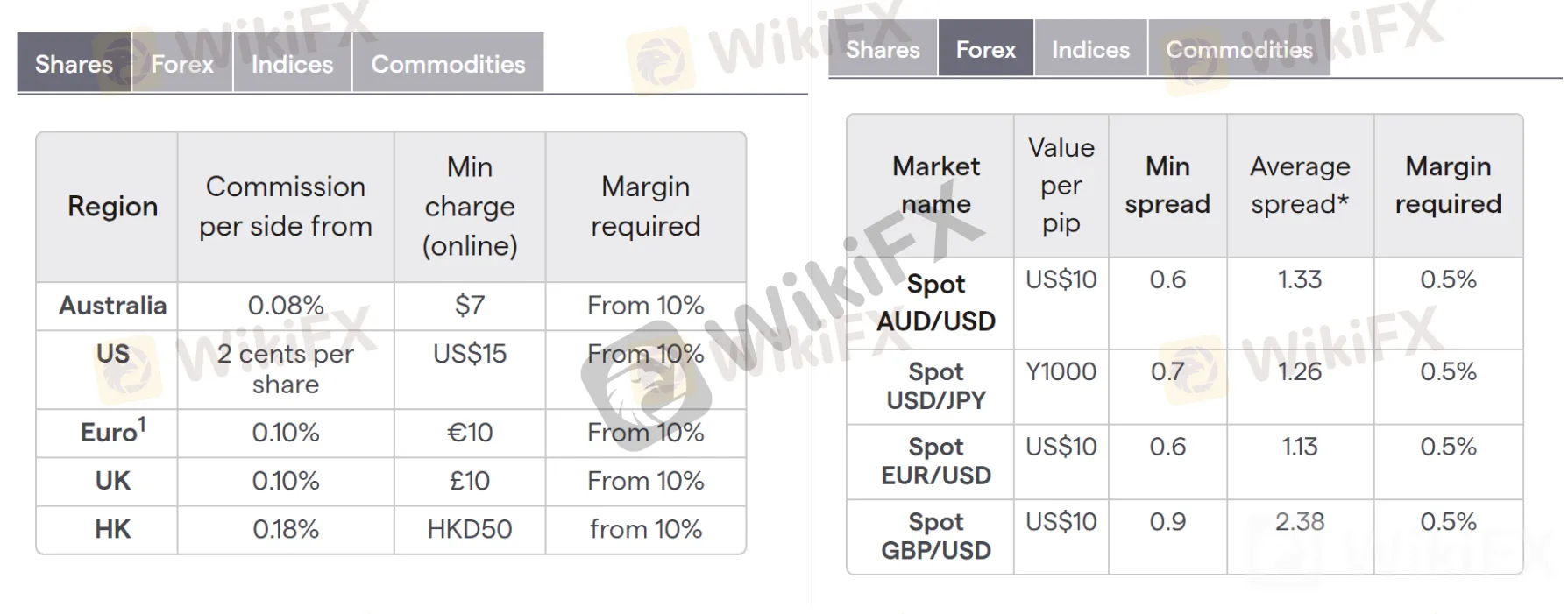

The value of the pips for your trade can vary depending on your lot size when you're trading. (A standard lot is 100,000 units of a currency, a mini lot is 10,000 units, and a micro lot is 1,000 units.)The difference in pips between the bid price (which is the price the seller receives) and the ask price (which is the price the buyer pays) is called the spread. The spread is basically how your broker makes money, because most forex brokers do not collect commissions on individual trades. When you're buying at the ask price (say, 0.9714) and a seller is selling at the bid price (0.9711), the broker keeps the spread (3 pips).

Many forex brokers quote prices to one decimal place after a pip. These divisions of pips are called pipettes and allow for greater flexibility on pricing and spreads.

Pip Values for U.S. Dollar Accounts

The currency you used to open your forex trading account will determine the pip value of many currency pairs. If you opened a U.S. dollar-denominated account, then for currency pairs in which the U.S. dollar is the second, or quote, currency, the pip value will be $10 for a standard lot, $1 for a mini lot, and $0.10 for a micro lot. Those pip values would change only if the value of the U.S. dollar rose or fell significantly—by more than 10%.If your account is funded with U.S. dollars and the dollar isn't the quote currency, you would divide the usual pip value by the exchange rate between the dollar and the quote currency. For example, if the U.S. dollar/Canadian dollar (USD/CAD) exchange rate is 1.33119, the pip value for a standard lot is $7.51 ($10 / 1.3319).

If your account is funded with a currency other than the U.S. dollar, the same pip value amounts apply when that currency is the quote currency. For example, for a euro-denominated account, the pip value will be 10 euros for a standard lot, 1 euro for a mini lot, and 0.10 euro for a micro lot when the euro is the second currency in the pair. For pairs in which the euro isn't the quote currency, you would divide the usual pip value by the exchange rate between the euro and the quote currency.Let's say you're trading the euro/British pound (EUR/GBP), and the bid price is 0.8881 and the ask price is 0.8884. You expect the euro to rise against the pound, and so you buy a standard lot of euros at the ask price of 0.8884. Later in the trading day, the bid price is 0.8892 and the ask price is 0.8894. You sell at the bid price of 0.8892. You gained 8 pips. If your account is funded with pounds, you made 80 pounds on the trade.